mississippi state income tax rate 2020

Find your gross income. File With Confidence Today.

U S Income Tax Revenues And Forecast 2031 Statista

Find your income exemptions.

. Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Tax rate of 3. 0 on the first 2000 of taxable income.

Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5000 spread across three tax brackets. Detailed Mississippi state income tax rates and brackets are available on this page. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income.

Six statesAlaska Illinois Iowa Minnesota New Jersey and Pennsylvanialevy top marginal corporate income tax rates of 9 percent or higher. State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation States With Highest And Lowest Sales Tax Rates Mississippi Tax Rate H R Block List Of States By Income Tax Rate See All 50 Of Them With Interactive Map There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India. Tax rate of 0 on the first 1000 of taxable income.

80-205 Non-Resident and Part-Year Resident Return. Check the 2020 Mississippi state tax rate and the rules to calculate state income tax. Mississippi has a graduated tax rate.

Individual Income Tax Notices. 5 on all taxable income over 10000. Discover Helpful Information and Resources on Taxes From AARP.

The graduated income tax rate is. From Simple To Complex Taxes Filing With TurboTax Is Easy. 3 on the next 2000 of taxable income.

Ten statesArizona Colorado Florida Kentucky Mississippi Missouri North Carolina North Dakota South Carolina and Utahhave. The income tax in the magnolia state is based on four tax brackets with rates of 0 3 4 and 5. Mississippi Code at Lexis Publishing.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. 80-160 Credit for Tax Paid Another State. Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracketTax Year 2019 Mississippi Income Tax Brackets.

Mississippi has a graduated income tax rate and is computed as follows. 80-115 Declaration for E-File. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001.

Box 23050 Jackson MS 39225-3050. 5 on all taxable income over 10000. Ad Compare Your 2022 Tax Bracket vs.

Calculate your state income tax step by step. Ad Answer Simple Questions About Your Life And We Do The Rest. Your 2021 Tax Bracket to See Whats Been Adjusted.

The tax brackets are the same for all filing statuses. Hurricane Katrina Information Resources. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent.

Mississippi state income tax credit. All other income tax returns P. Taxpayer Access Point TAP Online access to your tax account is available through TAP.

Mississippi Income Taxes. 4 on the next 5000 of taxable income. Find your pretax deductions including 401K flexible account contributions.

Tax rate of 0 on the first 1000 of taxable income. There is no tax schedule for Mississippi income taxes. 80-315 Re-forestation Tax Credit.

The list below details the localities in Mississippi with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Rates range from 25 percent in North Carolina to 12 percent in Iowa. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Any income over 10000 would be taxes at the highest rate of 5. Tax rate of 5 on taxable income over 10000. See the TAP section for more information.

Tax rate of 3 on taxable income between 1001 and 5000. Mississippis maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. These rates are the same for individuals and businesses.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. One possible source is the elimination of various tax deductions exemptions and credits. Tax rate of 4 on taxable income between 5001 and 10000.

80-155 Net Operating Loss Schedule. 3 on the next 3000 of taxable income. The mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2021.

0 on the first 3000 of taxable income. 4 on the next 5000 of taxable income. As you can see your income in Mississippi is taxed at different rates within the given tax brackets.

Married taxpayers must make more than 16600 plus 1500 for each qualifying dependent. 80-107 IncomeWithholding Tax Schedule. Tax Year 2020 First 3000 0 and the next 2000 3 First 4000 0 and the next 1000 3 Tax Year 2022 First 5000 0 250 per 1000 of capital in excess of 100000 Tax Year 2019 225 per 1000 of capital in excess of 100000 Tax Year 2020 200 per 1000 of capital in excess of 100000 Tax Year 2021.

For married taxpayers living and working in the state of Mississippi. 80-108 Itemized Deductions Schedule. What is Mississippi State income tax rate 2020.

TY 2019 2020.

There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India

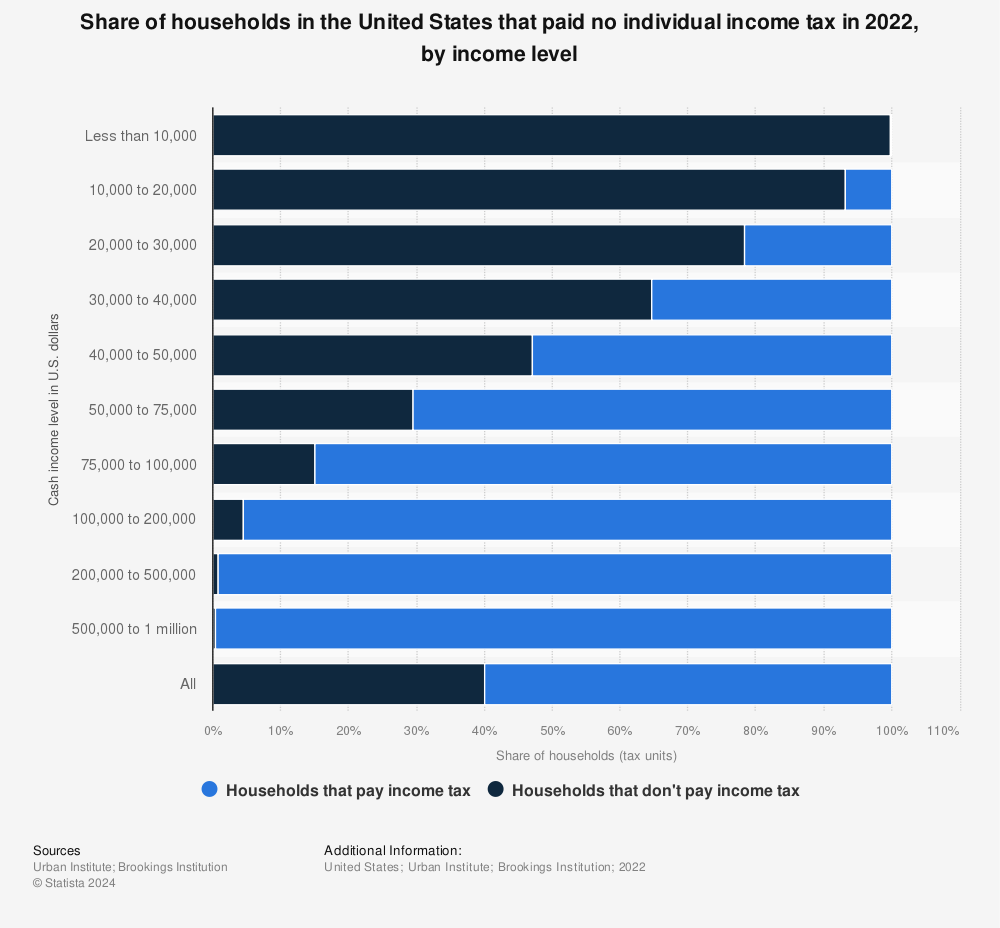

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

Low Tax States Are Often High Tax For The Poor Itep

How Is Tax Liability Calculated Common Tax Questions Answered

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

How High Are Capital Gains Taxes In Your State Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

Income Tax Corporate Tax Planning Mcqs For Ugc Net Commerce Income Tax Income How To Plan

Mississippi Tax Rate H R Block

States With No Income Tax H R Block

Colorado Income Tax Rate And Brackets 2019

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Latest Tds Rate Chart Fy 2019 20 Ay 2020 21 Basunivesh Tax Deducted At Source Accounting And Finance Income Tax

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)